DefiLlama the decentralized finance (DeFi) sector matures, the landscape is becoming increasingly fragmented across multiple blockchains, each hosting unique ecosystems of protocols and tokens. This cross-chain expansion presents both opportunities and challenges for investors and participants seeking to navigate this complex environment. DefiLlama, renowned for its comprehensive DeFi analytics, is at the forefront of addressing these challenges, ensuring its role as an invaluable resource within the DeFi community. This article explores the significance of cross-chain analytics, how DefiLlama is pioneering in this area, and its future trajectory in tandem with the evolving DeFi sector.

The Significance of Cross-Chain Analytics in a Fragmented DeFi Landscape

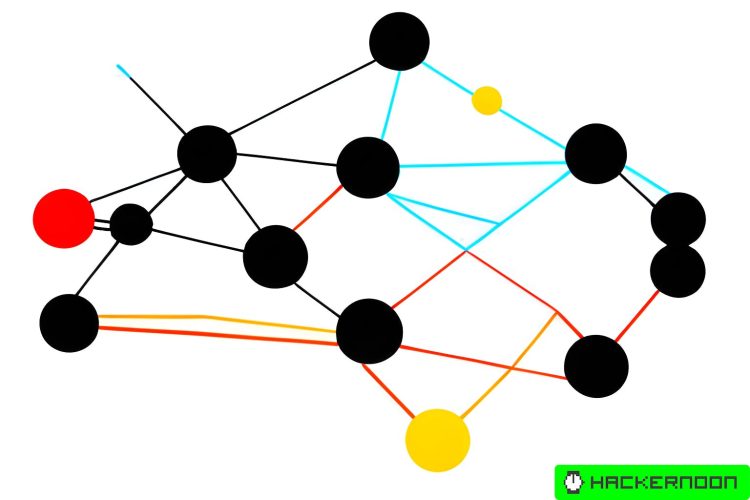

The DeFi ecosystem is no longer confined to a single blockchain. With the advent of multiple chains offering various advantages in terms of transaction speed, costs, and scalability, users and developers are spread across a diverse set of platforms. This fragmentation necessitates cross-chain analytics to provide a unified view of the DeFi market, enabling investors to make informed decisions by comparing opportunities across different blockchains. Cross-chain analytics also play a critical role in risk management by offering insights into the liquidity and stability of assets dispersed over various ecosystems.

How DefiLlama is Addressing the Challenges of Aggregating Cross-Chain Data

Aggregating data from disparate blockchains is no small feat, given the variance in blockchain architectures, data formats, and the sheer volume of information. DefiLlama tackles these challenges head-on by employing advanced data aggregation techniques and developing partnerships with multiple blockchain projects. This approach ensures comprehensive coverage and up-to-date information across the DeFi spectrum.

DefiLlama’s methodology involves:

- Standardizing data points to ensure comparability across different blockchains.

- Utilizing blockchain nodes and APIs to fetch real-time data.

- Collaborating with DeFi projects for accurate and direct data reporting.

These efforts culminate in a platform that offers a holistic and accurate representation of the DeFi market, transcending the boundaries set by individual blockchains.

The Role of DefiLlama in Identifying Cross-Chain Arbitrage and Investment Opportunities

One of the most exciting aspects of cross-chain analytics is the identification of arbitrage and investment opportunities that span across different blockchains. By providing a unified dashboard that tracks yields, liquidity pools, and token prices across ecosystems, DefiLlama enables users to spot discrepancies and opportunities that would otherwise be obscured by the complexity of navigating multiple platforms.

Investors can leverage DefiLlama to:

- Compare yields on similar assets across different chains.

- Identify underexploited liquidity pools offering higher returns.

- Strategize cross-chain swaps to capitalize on price differences.

This capability not only enhances profitability for savvy investors but also contributes to the overall efficiency and liquidity of the DeFi market.

Predictions for How DefiLlama Will Evolve with the DeFi Sector

As the DeFi sector continues to innovate and expand into new blockchains and financial instruments, DefiLlama’s role as a cross-chain analytics platform is poised for significant evolution. Predictions for its future development include:

- Integration with Layer 2 Solutions and Sidechains: As DeFi projects adopt Layer 2 solutions for scalability, DefiLlama will likely expand its analytics to include these platforms, offering even more granular insights.

- Enhanced User Interface for Cross-Chain Analysis: Expect to see more sophisticated tools and features designed to simplify the comparison and analysis of cross-chain opportunities.

- Collaboration with Emerging Blockchains: DefiLlama may form partnerships with new and emerging blockchains to ensure early and comprehensive data integration.

- Predictive Analytics: Leveraging machine learning and historical data, DefiLlama could offer predictive insights into market trends and investment opportunities.

Conclusion

The future of DeFi is inherently cross-chain, and analytics platforms like DefiLlama are crucial for navigating this evolving landscape. By continuously adapting to the challenges of aggregating cross-chain data and enhancing its offerings, DefiLlama not only serves the current needs of the DeFi community but also shapes the future of decentralized finance analytics. As the DeFi ecosystem grows, so too will the tools and technologies that support its exploration, with DefiLlama leading the charge in cross-chain analytics.