Why Expat Compares Is Your Go-To for Comprehensive Insurance Solutions Abroad

As an expat, navigating insurance options can be overwhelming. With numerous plans and providers available, it can be challenging to determine what coverage fits your unique needs. Expat Compares simplifies this process by offering tailored insurance solutions specifically designed for expatriates, ensuring you find the right plan with ease.

You understand that having the right insurance is crucial for your peace of mind while living abroad. Expat Compares provides a comprehensive comparison of various insurance options, allowing you to assess coverage types and costs side by side. This platform empowers you to make informed decisions that best suit your lifestyle and health requirements.

Choosing Expat Compares means you gain access to expert insights and customized solutions that prioritize your well-being. By leveraging their resources, you can confidently secure the insurance coverage you need, making your expat experience smoother and more enjoyable.

Understanding Expat Insurance Needs

Navigating insurance options can be complex for expatriates. You need to address unique challenges and understand the types of insurance that cater specifically to your situation. Making informed decisions about coverage can protect your health and financial well-being while living abroad.

Challenges Faced by Expats

Expatriates often encounter specific challenges regarding health and insurance coverage. One prominent issue is the lack of local knowledge about healthcare systems. You may find yourself in unfamiliar territory with different medical practices and requirements. To help navigate these challenges,Expat Compares offers valuable insights and comparisons tailored for expatriates.

Another significant challenge is the varying degrees of coverage offered by local providers. Many expats discover that standard insurance policies do not cover essential services like evacuations or pre-existing conditions. Language barriers can also complicate the claims process, leading to potential misunderstandings with healthcare providers.

Finally, maintaining continuous coverage can be difficult, especially if you move frequently or return to your home country. Understanding these challenges helps you better evaluate suitable insurance solutions.

Types of Insurance for Expatriates

You have several insurance options tailored for expatriates. Health Insurance is crucial, covering medical treatment, hospitalization, and specialist visits. Many policies also include emergency evacuation, which is vital for ensuring access to adequate care.

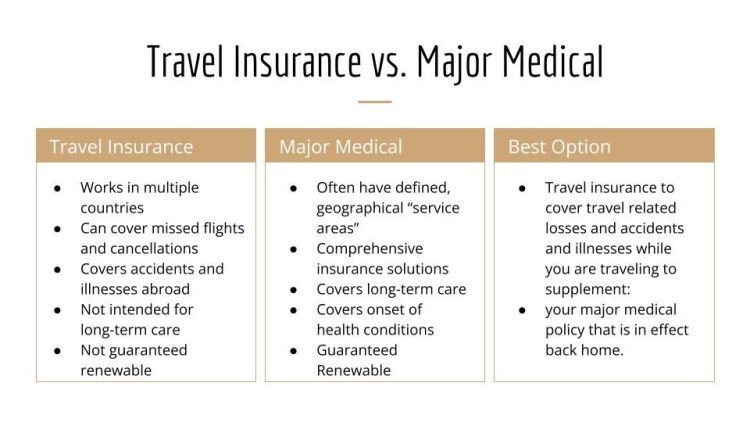

Life Insurance is another essential consideration. It provides financial security for your beneficiaries in the event of an unexpected loss. Additionally, travel insurance is beneficial, covering unexpected events during your time abroad, such as trip cancellations and lost luggage.

Property insurance can protect your belongings while renting or owning a home overseas. Lastly, liability insurance is important to shield you from legal costs if someone is injured on your property.

Evaluating these types of insurance helps ensure that you secure comprehensive coverage tailored to your unique expatriate needs.

How Expat Compares Simplifies Insurance Selection

Finding the right insurance can be challenging for expatriates due to varying options and unique needs. Expat Compares provides a streamlined approach to simplify this vital decision.

Process of Comparing Insurance

When you use Expat Compares, the process of comparing insurance becomes straightforward. You start by inputting your specific requirements, such as coverage type, location, and budget. The platform then presents you with tailored options that meet your criteria.

You can easily view and compare various plans side by side. This transparency allows you to understand the differences in premiums, coverage limits, and exclusions. You can filter results to focus on key elements that matter most to you, such as emergency services or family coverage.

Additionally, each insurance option links to detailed descriptions and benefits, allowing for informed decisions. This method reduces the time and confusion typical of traditional insurance searches.

Benefits of Using Expat Compares

Using Expat Compares offers several advantages that enhance your insurance selection process. First, it saves significant time. Instead of navigating multiple insurance websites, you review all options in one place.

Second, you gain access to a wealth of information tailored specifically for expatriates. Plans offered are curated to meet the needs of those living abroad, ensuring relevancy and efficiency.

Furthermore, the platform often features user reviews and ratings, providing insights from fellow expatriates. This experiential feedback helps you make more informed choices.

Ultimately, Expat Compares is designed to empower you with the knowledge and tools necessary for selecting the best insurance for your unique circumstances.

Choosing the Right Plan

Selecting the appropriate insurance plan can significantly impact your expatriate experience. Consideration of specific factors will help you make an informed decision that suits your needs.

Factors to Consider

When choosing an expat insurance plan, several factors should be evaluated. First, assess your personal health requirements. If you have pre-existing conditions, ensure that the plan covers these adequately.

Next, consider coverage areas. A comprehensive plan typically includes medical treatment, evacuation services, and repatriation. Compare the extent of coverage in various regions, especially if you travel frequently.

Cost is another crucial factor. Evaluate your budget and understand what premiums you can afford. Look for plans with clear pricing structures to avoid hidden fees.

Also, investigate the claims process. A straightforward, efficient claims procedure can save you time and stress in emergencies. Online reviews about the provider’s customer service can be invaluable.

Expert Recommendations

Experts suggest reviewing multiple expat insurance services before making a choice. Focus on reputable insurers known for their service quality. Seek plans with robust customer support, as this will be essential during emergencies.

Your insurance should align with your lifestyle. If you plan to engage in high-risk activities, opt for coverage that addresses these dangers.

Consider annual or multi-trip plans if you travel often, as they may offer better value.

Additionally, evaluate whether the plan includes add-ons for family members, especially if you’re relocating with dependents. Choosing a plan with flexible options enables you to adjust coverage as your needs change.

Frequently Asked Questions

Finding the right insurance solutions as an expatriate can be challenging. Understanding your needs, the benefits of specialized providers, and the unique aspects of expat insurance can help you make informed decisions.

How can expatriates find suitable health insurance coverage?

You can start by researching online platforms that specialize in expat health insurance. It is essential to compare different plans, coverage options, and premiums. Many websites provide quotes from multiple insurers, making it easier to find suitable coverage that meets your specific needs.

What are the benefits of securing insurance through an expatriate provider?

Expatriate providers often tailor their plans to meet your unique circumstances. They understand the challenges faced by expatriates, offering coverage that includes international hospitals and specialists. This means you receive support that is specifically designed for your location and situation.

In what ways do insurance needs differ for expatriates versus local residents?

Expatriates typically require more comprehensive coverage, including international travel and emergency evacuation. Local residents often have access to national health systems, which may not be available to you. This distinction means expatriates must consider global healthcare facilities and potential language barriers.

What factors should be considered when determining the cost of expat health insurance?

When evaluating costs, consider your age, health status, and the type of coverage you need. Premiums can vary widely based on the level of care and the geographical scope of your insurance. Additional factors include deductibles, co-pays, and any exclusions that may apply to your policy.

Why might a company choose to provide expatriate insurance for their overseas employees?

Companies often provide expatriate insurance to ensure the health and safety of their employees while abroad. This coverage helps attract and retain talent by offering peace of mind regarding healthcare access. It also reduces the company’s liabilities and demonstrates a commitment to employee welfare.

What are the common features of expat insurance plans?

Expat insurance plans typically include comprehensive medical coverage, emergency evacuation, and repatriation benefits. Many policies also offer access to a global network of providers and telemedicine services. Additionally, they may include wellness programs and coverage for preventive care, tailored to the expat lifestyle.